Typically, availing a home loan is a simple process. Once you find the lender you want to take the loan from, all you need to do is check the eligibility criteria, fill the application form and submit the documents. If approved, the lender would process your application, and the loan money would be deposited in your bank account.

However, the backend of a home loan can be a bit complicated. For instance, have you ever wondered how your home loan is calculated? How do lenders fix the EMI for you, and how does the difference in interest rates affect your total repayment value? Time to find out.

How Is Your Home Loan Calculated?

Lenders consider your loan amount, tenure and interest rate to calculate your home loan. There are two ways to do so, with a mathematical formula or with a home loan EMI calculator.

Mathematical Formula for EMI Calculation:

EMI = [P x R x (1+R)^N]/[(1+R)^N-1]

where,

P – Loan amount,

R – interest rate,

N – tenure in the number of months.

One can substitute the values in this formula to calculate the home loan and repayment amount.

What Is an EMI Calculator?

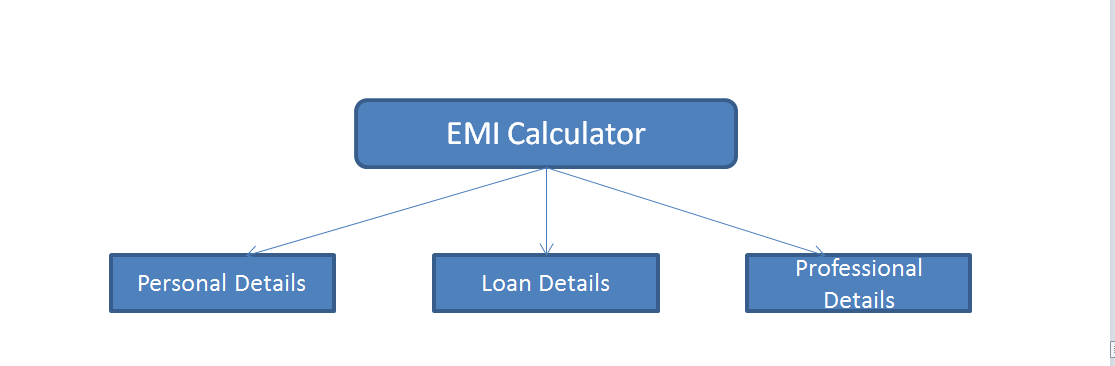

Home Loan EMI calculator is an online tool that helps you calculate home loan EMI and interest outgo with a few clicks. The calculator processes the details you fill in, and computes the requisite results. You can easily find an home loan EMI calculator online on the lender’s website. It is free and easy to use.

How Does the Home EMI Calculator Work?

You need to fill in a few details like the loan amount, tenure and interest rate of a home loan to calculate your EMI. You can either enter these details in the space provided or can use the slider to do so. Once you have entered the details, the calculator processes them to show the results instantly. You can use it any number of times to modify the tenure and loan amount and find an affordable EMI.

Benefits of an EMI Calculator

Plan your loan better – Once you know your EMI and repayment amount, you can make better decisions. Checking your EMI through an EMI calculator helps you know the total repayment amount with its breakup. This can help you plan your loan better. Accordingly, you can increase or decrease the loan tenure and alter your EMI. Moreover, you can also find out how much additional interest you need to pay by keeping a long tenure.

Accuracy – Unlike manual EMI calculations, the results of the EMI calculator are accurate and fast. You can use it any time of the day and any number of times.

Conclusion

While the lender usually does all the calculation for you when you avail a loan, it is always best to be aware of the process. Knowing the repayment amount of your home loan before making the purchase can help you manage your finances better/do better financial planning. It can also help you decide the right time for you to avail a home loan as per your financial stability.