Introduction

While an array of loan products exist on financial markets today, they require cumbersome documentation and are usually taken to meet large scale capital expenses in mind. However, there are times when you require small capital of up to Rs. 5 Lakhs to meet urgent obligations such as medical bills, tuition fees, travel and more. In such a scenario, few formal lenders are willing to take the risk and facilitate you for such small sums. Even if they agree to extend the loan, they follow the same protocol they usually undertake to offer large capital loans. This means that you would have to go through hassling paperwork and endless procedures to get the loan which is self-defeating because you have an urgent obligation to fulfill.

To meet this rising urgent and short-term financing requirements of the country, PaySense has partnered with PayU Finance to offer personal loans of upto Rs. 5 Lakhs that would help you meet small yet urgent obligations. What’s more, is that one can apply for the loan with minimal documentation online by availing the Personal loan from PaySense partners through Finserv MARKETS.

PaySense Interest Rates

The Personal Loans offered by PaySense partners are available at lucrative interest rates without any hidden charges. Since the loans are offered to fulfill short-term obligations, the interest is charged per month.

At present, PaySense partners personal loan interest rate is between 1.33% – 2.17% per month. Your final interest rate is determined by factors such as your CIBIL score and credit repayment history.

The borrower also has the option to choose if he/she wants to opt for a fixed or floating interest rate. Under the fixed interest rate system, the rate would be pre-decided by the lender between the aforementioned range and would not fluctuate with changes in the monetary policy. On the other hand, under a floating interest rate system, the interest rate would vary according to the Marginal Cost of Lending Rate (MCLR) decided by the Reserve Bank of India (RBI).

One must note that when one needs to meet certain urgent and small capital requirements, they often resort to informal lenders to get funds as quickly as possible. While doing so, they often also settle to pay high rates of interest. The personal loans offered by PaySense partners aim to revolutionise this informal sector by eliminating the unfair informal lenders by offering loans at rates which are standard in the formal sector.

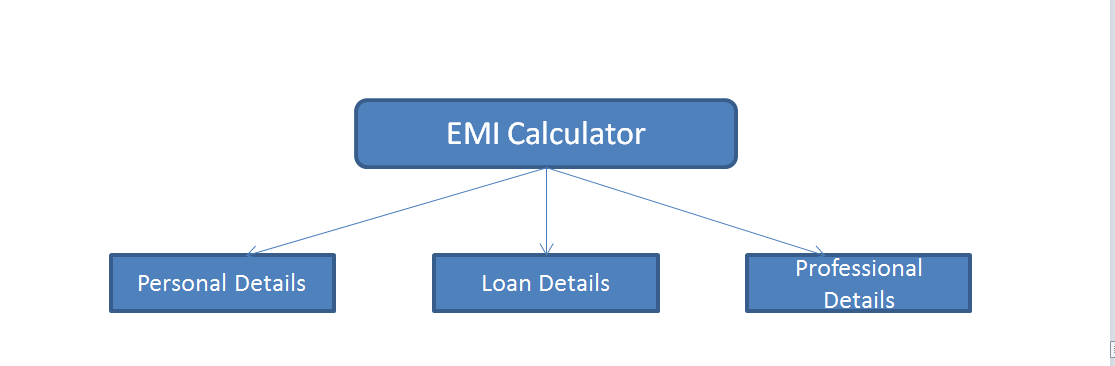

You can repay this small obligation through EMI’s so that they don’t pinch your pocket and feel like a regular expense. To get an exact quote, you can refer to the EMI calculator for Personal Loans by PaySense Partners, available on Finserv MARKETS

PaySense Eligibility Criteria

Personal Loans from PaySense Partners which are available on Finserv MARKETS have a very basic eligibility criteria that one needs to fulfill, in order to be eligible for the loan:

- The applicant must be an Indian citizen between the ages of 21-60.

- The applicant must be a salaried employee.

- The salary of the applicant must exceed Rs.20,001 in case they reside in a metropolitan city, or Rs. 18,001 in case they reside in any other city.

If you meet these basic requirements, you are qualified to receive the desired sum of money under Rs. 5 Lakhs in your bank account under 48 hours. You just need to head over to the Finserv MARKETS website and fill in a few forms.