How does the Options Trading Market Works?

Various stocks and bonds etc. constitute stock market portfolios. One of such categories is option trading assets. An Options trading course assesses the students about the clarity of the inclusiveness of the topic in an efficient manner as at times…

Term Insurance: Limited Pay vs Regular Pay

The premium is always a heavy point of focus while buying term insurance policy. A premium is the sum that you pay annually in exchange for life coverage. It is essential for your premium to fit into your budget and…

Tips on Choose a Checking Account Suited to Your Needs

One thing that most people need in order to conduct financial transactions with ease and convenience is a checking account. These accounts are ideal for having your salary paid in, make card payments and direct payments from, and conducting your…

Being money wise – Here’s how to get your YouTube channel started

Advancements in technology have given rise to many platforms where millennials can showcase their talent, without the constraints of age, education or qualifications. And YouTube has been a popular platform to have opened the door to immense opportunities for everyone…

Smart ways to reduce home loan interest rates:

The home loans are usually charged interest rates of 6-9% per annum to the borrower. However, some lenders may charge interest rates higher than 9% per annum. The loans thus availed are available for a tenure of 30 years maximum,…

Top tips for finding an online loan even if you have a bad credit history

A lot of people are looking for different ways on how to get the best bad credit small loan. There are lots of places where you can look for these loans, and one of them is the internet. In fact,…

PERSONAL FINANCE: HOW TO CHOOSE BETWEEN SIPS AND LUMP SUM FOR BETTER RETURNS FROM MUTUAL FUNDS?

lumpsum investment, lumpsum mutual fund, mutual fund lumpsum calculator, mutual fund investment, invest in mutual funds, SIP vs Lumpsum, lumpsum calculator, invest in lumpsum Are you confused if you should go with the SIP way of investing or lumpsum? Don’t…

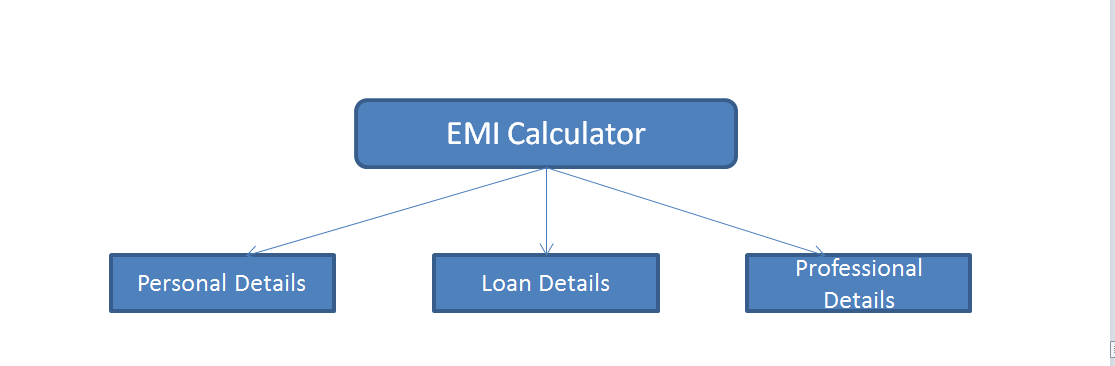

Know the Secret of Your Home Loan Calculation

Typically, availing a home loan is a simple process. Once you find the lender you want to take the loan from, all you need to do is check the eligibility criteria, fill the application form and submit the documents. If…

SIP Your Way Through Debt Market Volatility

You may have heard tons of different reasons why mutual funds are the investment option you should go for. More than that, you must have received all kinds of advice abut how to invest, how much to invest, etc. One…

Credit Platform PaySense: Loans made fast, simple and hassle-free

Introduction While an array of loan products exist on financial markets today, they require cumbersome documentation and are usually taken to meet large scale capital expenses in mind. However, there are times when you require small capital of up to…